Assisted Living Market Drivers, Restraints, and Growth Forecast 2025–2032

- James Figo

- Aug 1, 2025

- 3 min read

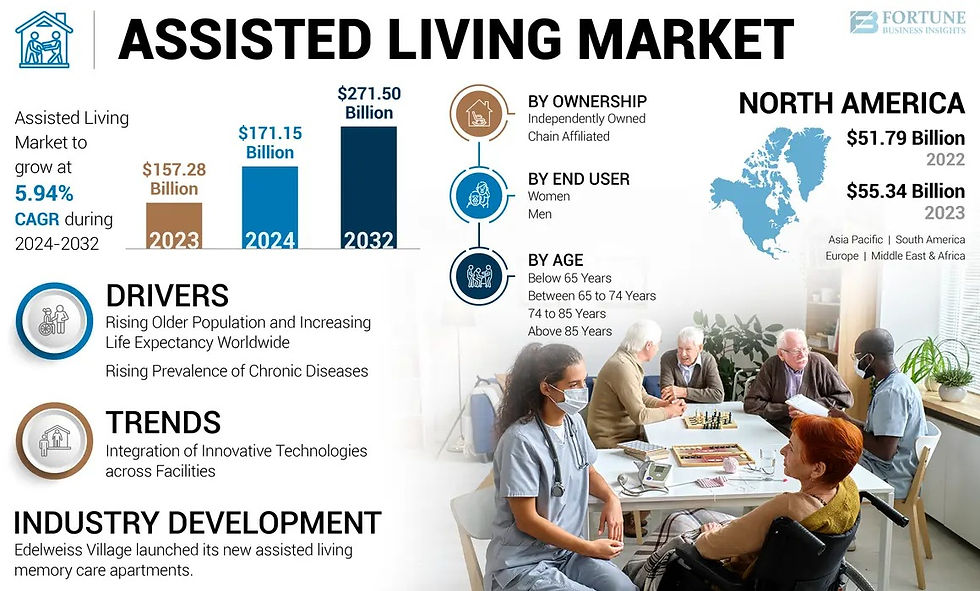

According to Fortune Business Insights, the global assisted living market was valued at USD 157.28 billion in 2023 and is expected to grow significantly, reaching USD 271.50 billion by 2032. This growth will occur at a compound annual growth rate (CAGR) of 5.94% during the forecast period. North America dominated the assisted living market with a market share of 35.19% in 2023.

Rising demand is driven by the increasing elderly population, longer life expectancy, and the growing need for personalized long-term care solutions. Assisted living facilities offer seniors and individuals with disabilities supportive housing and care services that promote independence while addressing daily activity assistance. The market expansion is further supported by advancements in healthcare technologies and the rising prevalence of chronic conditions among aging populations worldwide. This robust market growth underscores the evolving landscape of senior care and the increasing preference for assisted living as a vital care alternative globally.

Key Players in the Assisted Living Market

Brookdale Senior Living(U.S.)

Atria Senior Living(U.S.)

Sunrise Senior Living(U.S.)

Erickson Senior Living(U.S.)

Barchester Healthcare(U.K.)

ATHULYA Assisted Living(India)

Epoch Elder Care(India)

Clariane(Germany)

Dussmann Group(Germany)

The Flag(Germany)

Request a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/assisted-living-market-111474

ASSISTED LIVING MARKET TRENDS

Technology Integration Driving Market Expansion

The assisted living market in North America grew from USD 51.79 billion in 2022 to USD 55.34 billion in 2023, propelled by the widespread adoption of advanced technologies aimed at enhancing resident care and safety. Facilities are increasingly implementing telemedicine solutions, enabling residents to access healthcare services remotely and minimizing the need for frequent in-person visits.

In addition, the deployment of wearable fall detectors, pressure-sensitive floor mats, and emergency response systems ensures rapid intervention during emergencies, significantly improving safety outcomes. Virtual reality (VR) is also gaining traction within assisted living environments, offering therapeutic applications such as cognitive stimulation, virtual travel experiences, and memory enhancement exercises. This ongoing technological transformation is creating new growth opportunities and strengthening the appeal of technologically advanced assisted living facilities.

Market Segmentation Insights

By Ownership:

Chain-Affiliated Facilities held the largest market share in 2023.These chains ensure standardized quality of care and brand trust, making them a preferred choice globally.

By Gender:

The women segment dominated in 2023 due to higher life expectancy and a larger population of aging females.

By Age Group:

The above 85 years segment led the market in 2023.Rising life spans and demand for specialized geriatric care are fueling this growth.

Regional Outlook

North America:

Remains the leading region due to a growing elderly population, chronic disease prevalence, and affordable assisted living options compared to home healthcare or nursing homes.

North America led the global market with a dominant 35.19% share in 2023.

Europe:

Expected to witness notable growth during the forecast period due to an aging demographic and expanding elderly care services.

For detailed insights, visit the full report here: https://www.fortunebusinessinsights.com/assisted-living-market-111474

Market Drivers & Challenges

Key Growth Drivers:

Increasing elderly population worldwide

Higher life expectancy creating sustained demand

Rising need for long-term housing with healthcare assistance

Key Restraint:

Workforce shortage—a lack of skilled caregivers, nurses, and support staff remains a major hurdle in delivering quality services.

Competitive Landscape & Strategic Developments

The market is highly competitive, with leading global players investing in facility expansion to strengthen their presence and service capacity. Key players rely on brand trust and service quality to maintain market dominance.

Recent Industry Developments:

July 2024– Edelweiss Village (U.S.) launched new assisted living memory care apartments.

September 2022– Athulya Senior Care (India) opened a new facility in Bengaluru offering 24/7 clinical care, geriatric assistance, housing, and more.

December 2020– Antara Senior Living (Max Group, India) launched a 37-bed care facility in Delhi, offering daily assistance and elder care services.

Comments