Vaterinary Care Market Growth Potential and Market Entry Strategies

- James Figo

- Aug 12, 2025

- 4 min read

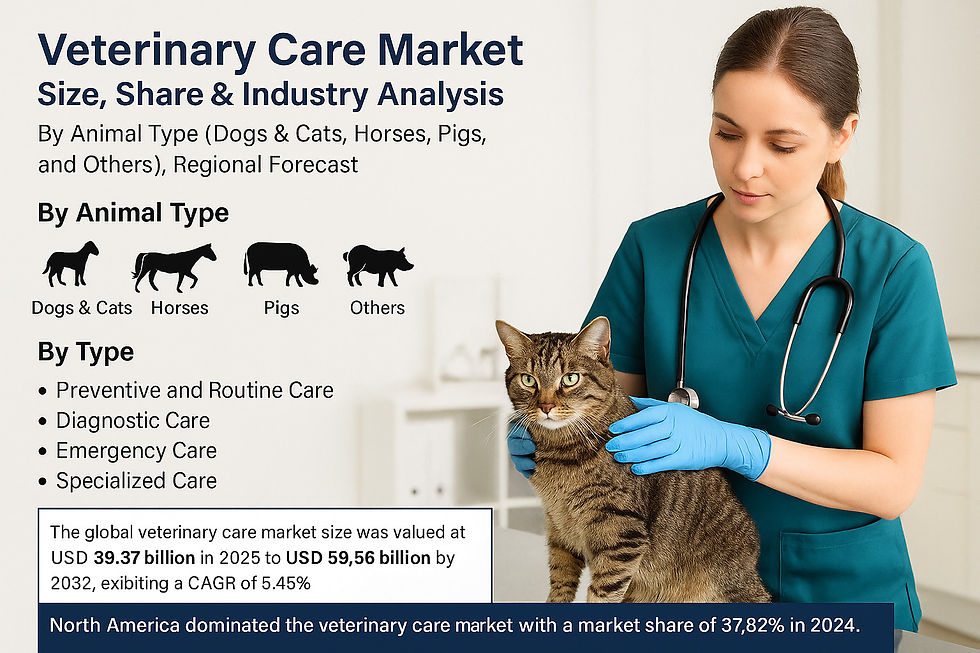

According to Fortune Business Insights, the global veterinary care market size is on a steady growth trajectory, expected to increase from USD 41.07 billion in 2025 to USD 59.56 billion by 2032, reflecting a CAGR of 5.45% during the forecast period. In 2024, the market was valued at USD 39.37 billion, with North America leading at 37.82% market share due to its advanced pet care infrastructure, high pet health awareness, and rising rates of pet adoption. Veterinary care covers the diagnosis, prevention, and treatment of animal diseases, spanning both companion animals like dogs and cats and livestock such as pigs and horses. Services range from routine health checkups to specialized treatments, including orthopedic surgeries and spaying/neutering. Additionally, the sector plays a vital role in controlling zoonotic diseases—illnesses that can be transmitted from animals to humans—highlighting its significance in both animal and public health.

Request FREE Sample Copy of Veterinary Care Market Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/veterinary-care-market-113080

Key Trends

Increasing Focus on Animal Health Awareness

Animal health awareness campaigns by governments, NGOs, and veterinary clinics are bolstering market growth. Pet owners today are more educated on preventive healthcare, thanks to health camps, teleconsultation services, and online platforms. This growing awareness is particularly notable in emerging markets, where access to veterinary services is expanding rapidly.

The global veterinary care market, valued at USD 41.07 billion in 2025, is projected to reach USD 59.56 billion by 2032, growing at a CAGR of 5.45% driven by rising pet adoption and advanced animal healthcare services.

Competitive Landscape

Leading companies are focusing on geographic expansion, innovation, and product development to strengthen their market presence. Key players include:

Zoetis Services LLC (U.S.)

Merck & Co., Inc. (U.S.)

HESTER BIOSCIENCES LIMITED (India)

Ceva (France)

IDEXX (U.S.)

Vetoquinol (France)

Crown Veterinary Services Pvt. Ltd. (India)

Antech Diagnostics, Inc. (U.S.)

Virbac (France)

Boehringer Ingelheim International GmbH (Germany)

Market Dynamics

Market Drivers

Rising Pet Adoption Worldwide

The growing trend of pet ownership across age groups has become a significant market driver. Pets are increasingly valued for companionship, emotional support, and improved mental well-being. Developing nations like India, Brazil, Thailand, and Vietnam are witnessing a surge in pet adoption, supported by online platforms spreading awareness.

According to the American Veterinary Medical Foundation (AVMF), between 2016 and 2020, U.S. households owning dogs rose from 38% to 45%, while cat ownership climbed from 26% to 29% between 2020 and 2022. Such trends are fueling demand for preventive, diagnostic, and specialized veterinary services.

Market Restraints

Increasing Cost of Veterinary Services

The rising cost of veterinary care, driven by high operational expenditures, labor shortages, and regulatory pressures, is a key restraint. The Independent Veterinary Practitioners Association notes a 60% rise in service costs over the past decade. As specialized care becomes more complex, the need for highly trained veterinarians raises expenses, potentially limiting access to care.

Market Opportunities

Integration of Advanced Technology

The integration of cutting-edge technologies such as MRI, laparoscopy, ultrasound, and telehealth services is transforming animal healthcare. These innovations improve diagnosis, treatment outcomes, and client engagement. Social media is also playing a pivotal role in promoting veterinary awareness and expanding customer reach.

Segmentation Analysis

By Animal Type

Dogs & Cats dominate the market due to high adoption rates and increased owner awareness regarding regular checkups and advanced treatments.

The horse segment is projected to witness robust growth, aided by online adoption platforms and rising equine healthcare investments.

By Type

Preventive and Routine Care holds the largest market share, fueled by increasing demand for vaccinations, wellness exams, and parasite prevention.

Diagnostic Care is expected to grow at the highest CAGR, with pet owners seeking early detection methods such as blood tests, biopsies, and imaging for illness prevention and management.

Regional Insights

North America (USD 14.89 Billion in 2024)

North America leads the global veterinary care market due to high pet ownership, advanced infrastructure, and increased awareness. As per the American Pet Products Association (APPA), 70% of U.S. households—about 90.5 million families—owned pets in 2021–2022. The region continues to invest in advanced diagnostic and treatment services.

Europe

Europe is projected to grow at a considerable CAGR, driven by increasing pet ownership and enhanced diagnostic capabilities in nations like Germany, the U.K., France, and Italy. Over 90 million households in Europe owned pets in 2021, with cats leading in popularity.

Asia Pacific

Rapid urbanization, rising disposable income, and pet humanization trends are fueling growth in the Asia Pacific region. Countries such as India are seeing a boom in pet care due to favourable demographics and increased spending.

South America and Middle East & Africa

These regions are expected to experience significant growth owing to increasing pet adoption, health awareness, and support from NGOs and government-led campaigns. Countries like Brazil, Argentina, and the UAE are emerging as key contributors to regional expansion.

Recent Developments

December 2024 – Mars, Incorporate, a U.S.-based company, has invested in Crown Veterinary Services to enter into India's veterinary care sector. The investment will help the company enhance its business in India and improve its customer reach.

November 2024 – Walmart Inc., a U.S.-based omni-channel retailer, has announced to expand its pet care services by opening five new Walmart Pet Services Centers in Georgia and Arizona. This center will offer veterinary care services such as veterinary prescription drug delivery and veterinary telehealth.

The veterinary care market is poised for steady expansion as pet adoption continues to rise, particularly in emerging economies. Despite cost-related challenges, advancements in diagnostics and telehealth services, combined with growing animal health awareness, are expected to unlock new growth opportunities for industry players in the coming years.

Comments